Food systems impacts of COVID 19

Food systems impacts of COVID 19

Posted by Steve Guilbert

29 June 2021

By Tim Wilkinson and Matt Lobley

Context

We sent 4000 paper questionnaires to land managers in the South West in late October 2020; sending reminders and receiving responses until early December 2020. We received 1117 completed surveys; a 28% response rate. The survey was distributed to farmers in the wider South West including Cornwall, Dorset, Devon, South Gloucestershire, Somerset, Wiltshire and the Isles of Scilly. We aimed to achieve a cross-section of farm type, size and farmer age group to ensure we had a variety of farms represented in the sample.

Any survey like this is just a snapshot in time and the results should be seen in the context of Winter 2020, when many were expecting a small but relatively normal Christmas and trade negotiations with the EU were yet to be concluded. If we asked many of the questions in the survey again today, we might well receive very different responses.

Respondent Profile

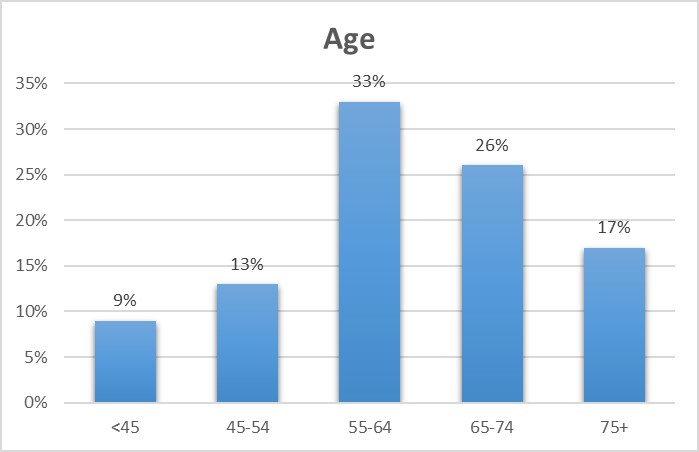

In our supporting material for the survey we asked that the person responsible for day-to-day management of the farm to complete the questionnaire where possible. Respondents were aged from 23 to 98, with a mean age of 63 years (slightly older than the national average). Respondents aged 54 years and under comprised 22% of the sample, 33% were aged 55-64 and 45% were aged over 65. The sample comprised 10% female respondents and 90% male respondents. Most of the respondents were intergenerational farmers; with just 15% reporting they were first generation.

Farm Profile

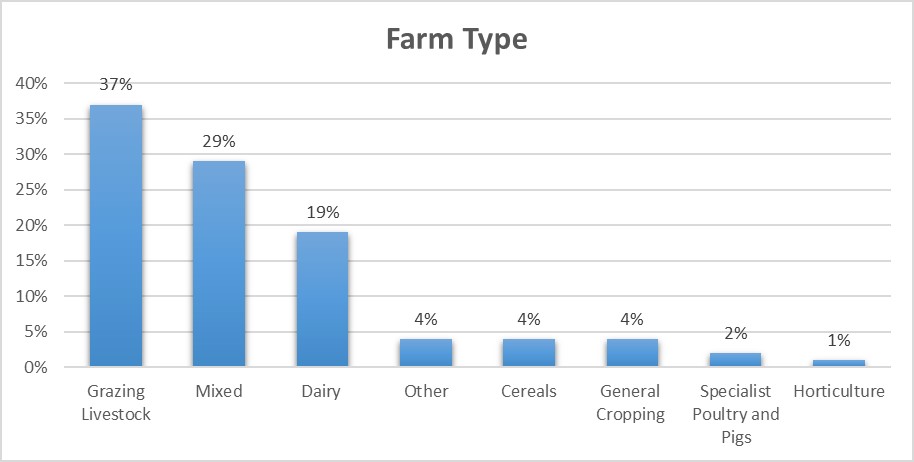

We received responses from a range of farm types, mainly comprising Grazing Livestock (37%), Mixed (29%) and Dairy (19%), but including Cereals (4%), General Cropping (4%), Specialist Poultry and Pigs (2%) and Horticulture (1%). This mix is broadly what we would expect from the region, given its topography and grasslands, and what we’ve found in previous surveys.

We had a good range of farm sizes represented. One quarter (25%) of the sample were farms under 50ha in size, another quarter (27%) between 50ha and 100ha. Larger farms were represented too; 14% over 250ha.

The Farm Business

We asked participants what the economic performance of the farm business was like compared to 5 years ago. Half of respondents said the business was doing about the same; 28% said they were doing better, 22% said they were doing worse.

We asked participants how they saw the economic prospects of the farm business over the next 5 years; answers were on a linear scale from bad to excellent. Just over half (51%) said the business prospects were ‘fair’, however 27% said ‘poor’, 6% said ‘bad’. There were those who expected a brighter future; 15% said they thought business prospects were ‘good’. Just 1% said they thought business prospects were ‘excellent’. We compared these results to data from the 2016 South West Farm survey; they were almost identical for every category (poor, fair etc.). Looking at the 2020 data by farm type for Livestock, Dairy and Mixed farms, Dairy farms were the most confident with 21% saying they thought their prospects for the next five years were Good compared to 11% and 13% who saw their prospects as ‘Good’ on Grazing Livestock and Mixed farms respectively.

Covid Impacts

Farmers reported a wide range of problems and benefits arising from Covid. We thought it was interesting that 12% of respondents reported neither problems nor benefits arising from Covid, suggesting that Covid did not seem to be impacting a small percentage of South West farmers in Winter 2020.

If we just look at the question we had on problems arising from Covid, 38% of farmers said they had no problems. Of those who reported problems, 21% said they had lost non-farming income such as from tourism rental. Reductions in the price of farm products was reported too (15%), as was reduction in the price of milk (12%). Less time being available due to caring responsibilities (such as childcare, or caring for relatives) was noted by 11%. A large range of other problems were reported, including public trespass, stress, lower staff productivity and availability, shielding and production being capped.

Answering a question about any benefits arising from the pandemic, 25% said they were seeing no benefits. Of those who reported benefits, 24% reported higher prices of farm products. Interestingly, several of the other most noted benefits were about relationships; 23% reported improved relations with the local community, 9% reported more positive interactions with other farmers and 9% reported closer relationships with buyers. New markets (7%) and demand for direct sales (1%) were mentioned, but certainly not as frequently as one might have expected from looking at media reporting around direct sales.

Plans for the Future

We asked respondents a number of questions about what was influencing their plans for the future. Almost half of farmers (49%) disagreed with the statement that the impacts and uncertainties of Covid were influencing their plans for the future. Nearly a third (32%) were ambivalent, neither agreeing nor disagreeing. Given wide ranging impacts of Covid, it is interesting that only 20% of farmers agreed that Covid impacts and uncertainties were influencing their plans for the future. This may be partly a factor of the timing of the survey – perhaps some felt that the pandemic would soon be coming to an end. But it may also relate to the outdoor nature of much farming work. Compared to the role of future ELMS schemes and climate change, Covid impacts and uncertainties seem to have had less influence on plans.

| Disagree | Neither | Agree | |

| Future ELMS schemes | 23% | 32% | 45% |

| Climate change | 26% | 33% | 41% |

| Reducing carbon emissions | 30% | 33% | 37% |

| International trade deals | 31% | 40% | 28% |

| Covid impacts and uncertainties | 48% | 32% | 20% |

Brexit

South West farmers were broadly ambivalent about how they thought their farm, the South West and UK would fair outside the European Union. A quarter of respondents strongly disagreed that their farm would struggle outside the EU. The timing of the survey (Oct/Nov 2020) should be noted here; we wonder what respondents would say if we asked this question again now.

| Strongly Disagree | Disagree | Neither | Agree | Strongly Agree | |

| My farm will prosper outside the EU | 13% | 16% | 43% | 15% | 13% |

| My farm will struggle outside the EU | 25% | 18% | 33% | 14% | 10% |

| Farming in the South West will prosper outside the EU | 14% | 19% | 42% | 15% | 11% |

| The UK will prosper outside the EU | 14% | 19% | 42% | 15% | 10% |

Data and Acknowledgements

We would like to thank Vanessa Rowan Johnson and David Andrews for their generous support of the South West Farm Survey 2020.

Please do not reproduce these figures without permission; contact Timothy Wilkinson t.j.wilkinson@exeter.ac.uk

Please note that figures have been rounded to the nearest whole number; so totals may not sum to 100%.