Hello, future scholars! I’m Daisy, a postgraduate who has successfully navigated the financial hurdles of university life. When I first chose to attend the University of Exeter, like many of you, I was filled with excitement but also anxiety about managing my finances. The questions swirling around in my mind—”Will I be able to afford it?” or “How do I budget without sacrificing my quality of life?”—were overwhelming. I know these worries can hold you back, but I’m here to help guide you through it.

When you think about heading off to university, a kaleidoscope of images likely dances before your eyes: late-night study sessions, lifelong friendships forged over coffee, and the thrill of intellectual discovery. Yet, amidst this academic utopia looms a shadow – financial strain. But don’t worry! With some savvy planning and smart strategies, you can enjoy your university years without constantly worrying about money. In this blog, I’ll share my personal experience, practical tips, and money-saving hacks to make your university life in the South-West both affordable and enjoyable.

The reality of living in the South-West

One of the most common concerns about studying in the South-West, particularly in Exeter, is that the cost of living can be higher compared to other regions. While this might be true in some areas, there are plenty of ways to manage your budget wisely. Let us dive into the specifics, focusing on food, housing, and other living costs, so you can feel more confident about your financial future.

Instalment payments: a lifesaver for cash flow

A great way to alleviate some of the financial pressure is by taking advantage of instalment payments for tuition fees and rent. Instead of paying large sums upfront, spreading these payments over the year can help you manage your cash flow more effectively. This is particularly useful if exchange rates fluctuate when you need to pay, as it allows you to avoid paying all at once during a high-rate period. This enables you to save or invest any remaining money rather than depleting your savings at once.

Accommodation: your biggest expense

Accommodation is often the biggest expense for students. Rent in Exeter can broadly vary between £140 and £350 per week depending on the location and type of accommodation (private or University-owned, ensuite or studio). For example, the price of a studio with a personal kitchen is higher than an ensuite room, where you have your own bathroom but share a kitchen with others. If you like socialising with roommates or cooking and sharing the kitchen together, an ensuite can be a good choice. If you enjoy your private space, a studio would suit you well. A small tip: it is not always cheaper if you apply for accommodation early as during the period of July and August, some accommodation options may offer discounts or coupons for remaining rooms.

If you would like to spend more time looking for housing to get a bargain, consider sharing housing with several roommates and renting a private house, or living with local people. The fees can be down to £145, but usually these houses are in more remote areas, so commuting fares may be considerable. I recommend using apps like Rightmove and SpareRoom, as they may help you find better deals if you’re willing to live off-campus and can help you decrease your rent fees dramatically. University and student accommodation options often include bills like heating and water, but a privately rented house may not. Therefore, I advise you to read the contract carefully and find some good friends to share the rent with in advance.

Food: eat well without breaking the bank

Food is another major expense, but there are plenty of ways to eat well without breaking the bank. The days of surviving on pot noodles as a university stereotype are gone. Smart shopping can transform your grocery budget. One trick is meal planning: dedicate some time each week to plan what you’ll eat and make a grocery list based on that. This not only prevents impulse buying but also reduces food waste. Cooking in bulk and freezing portions for later means you’ll have quick meals ready when you’re too busy to cook.

You can buy budget-friendly ingredients at places like Aldi, Lidl, and Morrisons. You can buy cheaper ingredients when they are close to expiration, as the clearance goods often have a good deal. But usually, my favourite foods have no chance of having the yellow clearance label! However, it’s not necessary to sacrifice and wait for a clearance bargain to be economical.

Another great option is Olio, an app that allows people and businesses to share surplus food for free, where you can be a food hero and collect food from surrounding markets for free. You’ll be surprised how much food you can get while contributing to the local community and environment. But remember, you must ensure it’s safe and suitable for consumption, and make sure to use what you collect, thereby contributing to the goal of waste reduction.

If, like me, you are a microwave user and enjoy fast-cooked or ready-made meals, you can take advantage of Meal Deals in shops such as Tesco, Pret, or Coop, etc. A good store with plenty of frozen food is Iceland. You can enjoy a variety of delicious options from there.

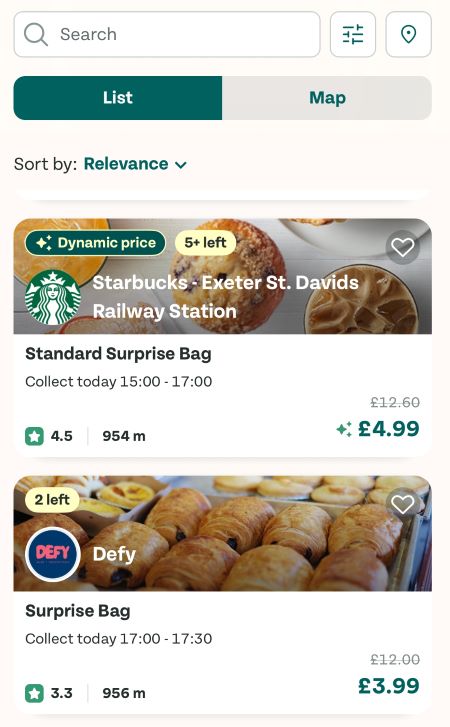

When you’re tired of eating pizza or burgers, you might want to try Too Good To Go. This service offers heavily discounted meals from popular shops, cafes, and restaurants, often at a fraction of the original price, and the food depends on what remains on that day. You can buy “Magic Bags” of surplus food that would otherwise go to waste, saving a lot on daily meals-a win-win! For students, this is a wonderful way to enjoy fresh dishes at much lower costs.

One amazing thing is you might encounter free pizza nights or food giveaways on any given day. Seek out these free sources of food to stretch your budget further. In addition to free food, I recommend these activities and societies as well.

Transportation: walk, cycle, or save on public transport

If you live close to campus, walking or cycling is a fantastic way to save on transport costs. Exeter is very walkable, with Streatham Campus a 20-minute walk from the city centre and St Luke’s Campus just a 10-minute walk. If you need public transport, bus fares are around £2 per trip. If you have some friends with the same timetable and live close by, sharing taxi fees together can sometimes be even lower.

I hope your life in the UK isn’t just limited to your university accommodation. You could travel to different cities or take part in various activities. In this regard, investing in a student bus pass or Railcard can slash these costs significantly (for example a Railcard offers a 1/3 discount on rail fares). A Railcard costs £30, but you can get a great discount if you purchase it through Trips, Railcard, or other apps. The availability of this offer is limited, so if you haven’t taken advantage of it yet, make sure not to miss out.

Student discounts: maximise every penny

One of the biggest perks of being a student is the abundance of discounts available to you, from groceries and clothes to entertainment and travel. From UNiDAYS and Student Beans to local shops and restaurants, there are plenty of ways to save money on essentials. The apps regularly update their offers, so check them out! Even a small discount can add up over time, so never hesitate to flash your student card and ask for a deal!

Free entertainment: make the most of what’s around you

The South-West is full of free and low-cost activities, from hikes along the coast to exploring charming villages. On-campus societies often host free or heavily subsidized events, providing endless opportunities for affordable fun. Joining these groups not only helps you meet new people but also stretches your entertainment budget. As for the train fares, don’t forget to grab your Railcard.

For example, when walking along the quay to Exmouth, the scenery along the path is quite attractive. You can also choose bus No. 57, which for only £2 can take you to the seaside. The coastline, with its long beaches and salty winds, offers a refreshing escape from busy city life. Additionally, you can even find fossils on the beaches near Sidmouth, providing scenic walks along the South West Coast Path. Another famous natural beauty is Dartmoor, which is often chosen as a destination by many outdoor clubs and hiking teams. This vast, rugged moorland offers breathtaking landscapes, rolling hills, rocky outcrops (known as tors), and rich wildlife. The best way to get there is by taking the train to Okehampton and then following the trails. Of course, the National Park is too large to explore in just one day, and it’s a perfect destination for hiking, picnics, climbing, and camping, so, if you’re part of a group which organises a trip there, definitely don’t miss it.

Shopping: be a rational customer

As previously mentioned, students can take advantage of discounts at the shops and also collect bonus points through membership programmes. Primark and Poundland usually offer very low prices, making them a good choice if you need something urgently and don’t prioritize quality.

If you prefer to shop online, Temu is a popular app with extremely low prices, but the quality may not be the best. Additionally, purchasing items from second-hand groups or charity stores in the UK can be a cost-effective option, as the items are donated by members of the community. If you don’t mind second-hand clothes, this can help you save money.

Be cautious of numerous advertisements and large coupons, as they can lead to overspending. Creating a target list and budget can help you avoid making unnecessary purchases. Many “essential” items have cheaper alternatives, so it’s wise to think carefully before buying big-ticket items, especially if you’re a postgraduate staying for only a year. Items like screens, air conditioners, and bicycles can improve your quality of life, but they can be difficult to transport back to your hometown. If you plan to sell them to next year’s students, you may only get half of what you paid for them.

Budgeting: plan ahead, stay ahead

Now, let’s talk about budgeting. Apps like Monzo and Revolut make it easy to track your spending and set limits. Keep a record of your income (student loans, part-time work, family support) and expenses. Physically or digitally assign spending limits to various categories (e.g. groceries, entertainment) by putting money into a piggy bank first. Once the money in it is spent, consider stopping spending in that category until the next period. This method is effective in controlling overspending and boosting savings. Make sure to allocate enough for essentials like rent and food before spending on extras.

Below I will share my spending in a week (however remember this doesn’t cover tuition fees). If you want to be cost-effective, the fun cost, eating out and snacks can be cut. Meanwhile, sharing indigents with friends or bulk cooking can help you enjoy more balanced nutrition with a rich variety of vegetables and meats and bring your weekly food cost to below £40.

As well as the spending listed below, I also have some non-weekly spending, such as tuition fees. Some daily necessities were already purchased by the time the uni term started, so these also aren’t included here.

| Expenses | Spend per week | Notes |

| Rent (including utilities) | £200 | |

| Food (including groceries, meal deals and magic bags) | £46 | Many magic bags have an amazing amount and cheap price (£4), giving you enough food to eat over two days. The meal deals offer a drink, a snack and a sandwich for £4. |

| Laundry | £6 | |

| Fun money | £0-20 | Get tickets for lots of student events on FIXR There are also a lot of free trips and activities organized by societies or the Students’ Guild. Don’t miss them! If you like to have a drink with friends in a pub, you’ll also need to budget for the cost of this. |

| Eating out | £15 | Eating in restaurants is much more expensive than cooking for yourself, but it can be an enjoyable way to socialise. |

Final thoughts: don’t let finances hold you back

The thought of university expenses can be intimidating, but don’t let it stop you from pursuing your education. If you’re ever struggling, don’t be afraid to reach out to your university’s financial services. For example, Exeter offers support through bursaries, student loans, and finance services. There’s no shame in asking for help if you encounter financial problems. With proper planning and by taking advantage of the many opportunities to save, you’ll find that managing your finances isn’t as scary as it seems.

Studying abroad is an impressive and fulfilling experience, Exeter offers a fantastic quality of life that’s worth every penny. Stay smart, plan ahead, and make the most of the resources available to you.

Good luck and enjoy your university experience!