Hiya! Aamina here from the Sports and Health Sciences MSc program. In today’s blog, I’ll talk about the hidden costs of university life that you might not initially consider.

I know, not the most interesting topic. But you’ll benefit from this blog because I share smart money management tips that I would have loved to know when I started at the University of Exeter.

I estimated my living expenses back in early 2023 before starting my program and gathered funds accordingly.

And I thought I had more than enough.

But the rise in the cost of living is no joke. After moving to Exeter, I found myself spending more than I had calculated. So, I made some changes and thankfully, I haven’t had any major shocks when I check my weekly expenses.

And, yes, I’m one of those boring people who do weekly and monthly expense sheets on Excel and find it relaxing.

Well, most of the time.

It’s because I keep spreadsheets that I know how much I am now saving by implementing the tips you’ll read below.

Ready? Let’s lift the lid off some hidden costs and see how you can easily manage them:

Course Materials and Supplies

Most of us account for the costs of textbooks. But you may also need specific software, lab materials, art supplies, or other specialized equipment for your course.

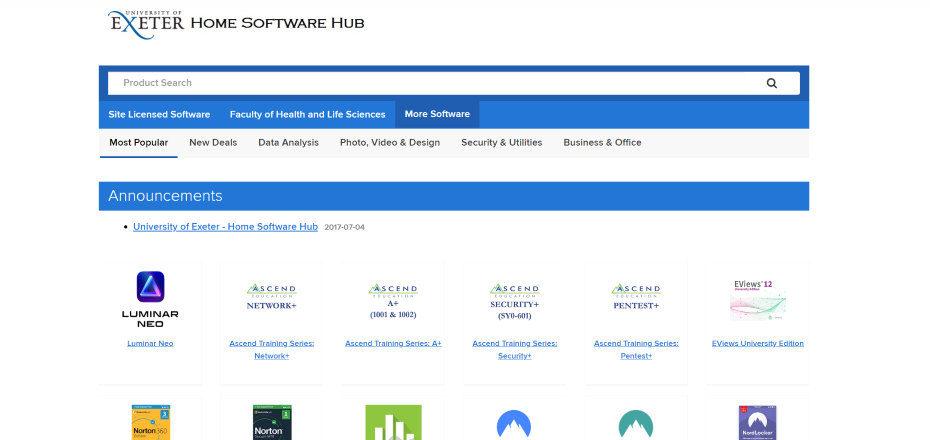

Luckily, the University of Exeter’s Home Software Hub has nearly every software you’ll need for studies. You can download and use them for free as long as you’re a student here. You also get free IT support to help you with technical issues with such software and hardware.

You may also need to buy some lab materials. Try asking your seniors about the best (read: cheap) shops depending on your course. It doesn’t hurt to ask seniors to sell you their supplies if they’re done with them. Bulk buying with your fellow students can also save you some money.

Certain fields may require students to invest in professional attire for presentations, interviews, internships, or practical placements. Check if your course does and arrange things from home or buy during Christmas or summer sales.

Transportation

In my last blog, I talked about my university accommodation on the Streatham campus. But my classes and labs are at St. Luke’s, which is 1 mile (or a 25-minute walk) away.

I prefer to walk on most days. But like most university students, I’m often running late and need to catch the bus.

And although the bus ticket is just £2, it quickly adds up and becomes significant.

If you find yourself in a similar situation or must travel a lot for part-time jobs or social activities, consider getting a student bus pass. Most public buses in Exeter are run by Stagecoach. They offer various types of student passes and most of them allow you to travel unlimited on local Stagecoach buses in specific zones.

Check out their app or website and choose the option you like based on duration (weekly, monthly, quarterly… you get the point).

Also, when you’re travelling abroad or moving around with a lot of luggage, you should factor in the taxi cost.

Food and Groceries

You might think of food and groceries as an obvious expense. But no one prepares you for the cost of impulse buying. When you don’t have your parents or another adult stopping you from buying a ton of ice cream, cereal, and chicken nuggets, you end up buying exactly that.

And don’t get me started on coffee and coffee shop croissants and baked goods.

Your bank balance will take a serious hit if you’re not mindful of your food and grocery shopping.

My tip: plan your shopping and list your groceries based on your meals. That way, you won’t overspend, and no food will get thrown out because it expired in your fridge. Plus, make your coffee at home on most days and keep the iced lattes as a treat for stressful exam weeks.

There’ll be plenty of time to enjoy these finer things later.

The University of Exeter also offer £2 meals which will be a literal lifesaver if you’re running low on funds.

Phone Bills and Internet

The university has high-speed free internet all over campus and in the accommodations. But if you travel a lot or spend most of your time off-campus, you’ll need a good mobile phone plan.

Compare the various options before coming to Exeter. Simply do a Google search and determine which provider and plan will work best for you.

It won’t be a major expense as most mobile network providers offer good packages for under £10. But, again, small expenses can quickly add up so it’s wise to account for them when you’re estimating your living expenses.

Entertainment and Socializing

Activities such as the cinema, outings and events contribute to the overall university experience but also to its cost.

Exeter Student’s Guild offers funds to help you pay for society membership. I think this is a great initiative because it allows everyone to take part in the university experience and makes societies very diverse.

Fitness and Recreation

Gyms and hobbies can also be expensive. Try to do as much as possible in public free spaces, such as running outside instead of in a gym, or buy exercise equipment online from places like Facebook Marketplace or Amazon and exercise in your garden. You can resell your dumbbells or other equipment when you leave.

The Northernhay Gardens and the Reed Pond on campus are two of my favourite spots to exercise because they both offer the most gorgeous views at any time of day.

Alternatively, search for places with a student discount. The University of Exeter’s gyms are amazing and offer discounts for active students and alumni.

Printing and Copying

Despite the digital age, many courses still require printed assignments or notes. And the cost can add up. Luckily, the University of Exeter gives every student access to the public printers in the libraries and nearly all academic buildings. Although you do have to pay per page, it’s a very small amount compared to what you pay in off-campus shops.

When you come to the University of Exeter, go to any printer and read the instructions on how to access your printing account that’s linked to your uni card.

Professional Development

Costs associated with conferences, workshops, networking events, or memberships in professional organizations can be significant. That’s especially true for healthcare or other fields needing licenses for practice.

There’s no cheap way around that, unfortunately. But you can claim tax returns on some professional registration costs. Although you’ll have to pay now, you may eventually get the money back.

Emergency Fund

Expenses such as laptop repair, healthcare issues, or travel for family emergencies can come out of nowhere.

Try to always keep a rainy-day fund, especially if you’re an international student because international bank transfers can take a few business days.

Graduation Expenses

We all dream of our graduation days, but somehow, don’t always consider its costs. Graduation cap and gown rental, photos, announcements, and tickets for family members to attend ceremonies can cost a lot.

But none of these things are mandatory, other than the cap and gown. Figure out how much everything will cost and cut down on things you can manage without.

For example, you can hire a local photographer or ask a friend to take photos and instead of having lots of people in attendance, arrange a dinner with them and enjoy with everyone in the afterparty.

Wrapping up

The hidden expenses I’ve talked about can vary widely depending on your lifestyle and spending habits. Here’s a quick review of the hidden costs:

- Software, course-specific add-on costs and professional registrations

- Transportation

- Reckless spending on groceries

- Graduation week expenses

- Socializing and fitness

By being aware of and planning for these hidden costs, you can better manage your finances and avoid stressful financial surprises during your university years.

If you’re having a hard time managing your budget or if you find it too stressful, remember you can reach out to the wellbeing team for support or personalised tips for your situation.

Happy budgeting!